Shares are falling, oil is above $ 110 after Russia’s sanctions bite

Broker reacts while trading at its computer terminal at a brokerage firm in Mumbai, India, February 1, 2020. REUTERS / Francis Mascarenhas

I’m registering

Broker reacts while trading at its computer terminal at a brokerage firm in Mumbai, India, February 1, 2020. REUTERS / Francis Mascarenhas

I’m registering

MSCI Asia former Japan -0.56%, Nikkei -1.68%

Euro Stoxx, DAX futures point to a lower opening

Brent oil jumped above $ 110, the highest level since early July 2014

Biden has announced a ban on Russian flights using US airspace

Yields in the US are recovering from eight-week lows

SHANGHAI, March 2 – Asian stocks came under renewed pressure on Wednesday as oil prices jumped above $ 110 a barrel as investors worried about the impact of aggressive sanctions against Russia on invading Ukraine.

European stock markets were set to open weakly after Tuesday’s crash, with Euro Stoxx 50 futures down 0.13% and German DAX futures down 0.17% in early deals. FTSE futures rose 0.34%.

In the latest tightening of restrictions on Moscow, the United States has banned Russian flights using US airspace following similar actions by the European Union and Canada.

I’m registering

US President Joe Biden announced the ban during a speech on the state of the union on Tuesday, in which he also said that Russian President Vladimir Putin would “pay a long price” for the invasion of Ukraine. Read more

MSCI’s broadest Asia-Pacific stock index outside Japan (.MIAPJ0000PUS) fell 0.56% and China’s blue chip index CSI300 (.CSI300) fell 1.12%.

Japan’s Nikkei (.N225) fell 1.68%.

In Australia, the base index ASX 200 (.AXJO) rose 0.28% despite the risk-averse risk aversion elsewhere as rising commodity prices boosted miners’ shares.

“The Russia-Ukraine conflict is likely to continue to dominate markets for the foreseeable future. Yesterday’s announcement that Russia will not pay coupons to foreign holders on its sovereign debt should push investors further to asylum,” ING analysts said in a note. .

“Support for the start of the EU membership process for Ukraine shows the unity of support for Ukraine from Western Europe, but is unlikely to help ease tensions.”

On Tuesday, the S&P 500 (.SPX) and Nasdaq Composite (.IXIC) closed about 1.6% lower, while the Dow Jones Industrial Average (.DJI) fell nearly 1.8%.

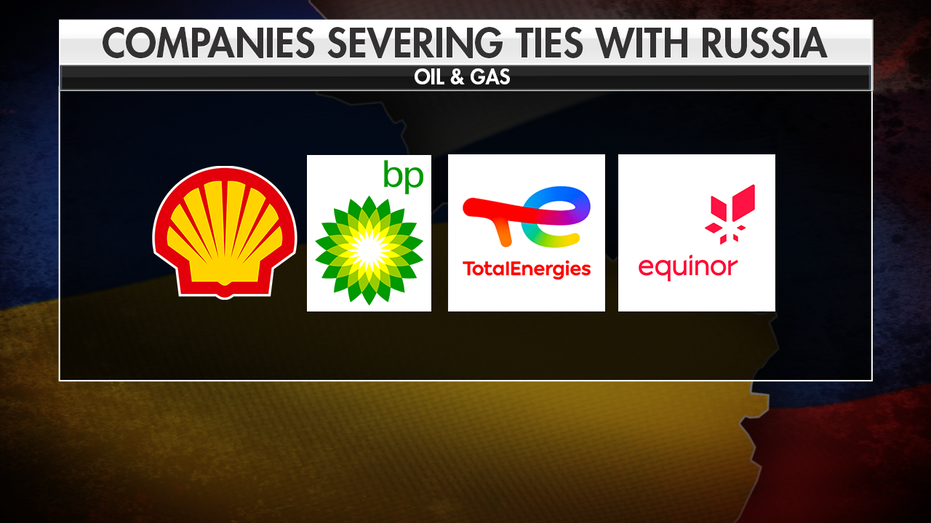

Global sanctions against Russia have prompted a number of large companies to announce the suspension or exit of their business in the country.

Exxon Mobil (XOM.N) said on Tuesday it would leave operations in Russia, including oil fields, following similar decisions by British oil giants BP PLC and Shell and Norway’s Equinor ASA. (EQNR.OL) read more

Exxon’s announcement comes as the price of oil continues to rise. On Wednesday, global oil Brent exceeded $ 110 a barrel, rising more than 5.8% to $ 111.09, the highest level since early July 2014.

US crude oil West Texas Intermediate jumped nearly 6% to $ 109.30, the highest level since September 2013.

The rise came despite a global agreement to release 60 million barrels of crude reserves to try to contain rising prices and rising inflationary pressures.

“We believe there is still room for oil prices to continue to rise,” said Carlos Casanova, senior economist for Asia at UBP in Hong Kong. “So much depends on political factors and ensuring that some of the supplies coming from Russia are offset by (not only) more oil than American shale, but also from Iran.”

In the foreign exchange market, the dollar rose 1.88% against the ruble to 107.01 after reaching a record high of 117 days earlier.

The dollar was also stronger against the yen, rising 0.12% to 115.03, while the euro fell to $ 1.1112. Against a basket of currencies of other major trading partners, the dollar strengthened 0.15% to 97,464.

The rise in greenbacks came as US government bond yields recovered after falling to an eight-week low on Tuesday. The changing outlook for global growth has prompted investors to cut bets that the Federal Reserve will aggressively raise interest rates in the coming months.

The 10-year reference yield in the United States rose to 1.7309% from 1.711% late on Tuesday, and the politically sensitive 2-year yield rose to 1.3205% from 1.305%.

Fed funds futures markets now value only a 5% chance of an increase of 50 basis points at the Fed meeting in March, although a smaller increase of 25 basis points is seen as virtual security. FEDWATCH

In a speech Tuesday, Biden called on companies to produce more cars and semiconductors in the United States so that Americans can rely less on imports as a way to fight inflation.

Gold, which peaked at an 18-month high last week and rose nearly 2 percent on Tuesday amid a worsening crisis in Ukraine, returned 0.57 percent to $ 1,932.11 an ounce as the dollar strengthened.

Bitcoin, which rose nearly 15.5 percent on Tuesday due to the strengthening of identity data for a conflicting currency, read more, was 0.23% lower at $ 44,341.68.

I’m registering

Report by Andrew Galbraith; Edited by Sam Holmes

Our standards: ‘ principles of trust.

Shares are falling, oil is above $ 110 after Russia’s sanctions bite Read More »

They say the crypto market is not big enough or deep enough to sustain the volume Russia needs, and that the country’s digital asset infrastructure is minimal.

Former US Secretary of State Hillary Clinton and current European Central Bank President Christine Lagarde are among high-ranking officials worried that the cryptocurrency could provide a means for Russia to circumvent the heavy financial sanctions imposed on its invasion of Ukraine.

The country is largely cut off from the SWIFT cross-border transaction system, and businesses in the United States and other Western countries are banned from doing business or doing business with Russian banks and the National Welfare Fund.

The head of the policy in the promoter of the crypto policy of the Blockchain Association in the USA Jake Chervinsky published a long Twitter the end on March 2, explaining how “Russia cannot and will not use cryptocurrency to evade sanctions.”

1 / Russia cannot and will not use cryptocurrency to avoid sanctions.

Concerns about the use of cryptocurrencies to avoid sanctions are completely unfounded. They are fundamentally misunderstood:

– how sanctions work

– how crypto markets work

– how Putin is actually trying to ease sanctions

I will explain

– Jake Chervinsky (@jchervinsky) March 1, 2022

Chervinsky cited three reasons why Russia is unlikely to use cryptocurrency to circumvent US sanctions. The first is that sanctions are not limited to US dollars, and it is now illegal for any American business or citizen to make deals with Russia. He said”It doesn’t matter if they use dollars, gold, seashells or bitcoins.”

The second reason is that the financial needs of a nation like Russia far exceed the current capabilities of the crypto markets that Chervinsky Called “Too small, expensive and transparent to be useful to the Russian economy. In other words, even if Russia had access to sufficient liquidity, it would still not be able to hide its transactions in such a market.

Finally, the country spent years trying to “prove sanctions”, but failed to build any significant crypto infrastructure or even finalize crypto regulations. Chervinsky says cryptocurrency simply does not appear to be part of Russia’s plans to mitigate the effects of the sanctions.

“The reality is that Putin’s years have been trying to protect Russia from sanctions, and cryptocurrency is not part of his plan. His strategy included diversifying Russia’s reserves into yuan and gold (not cryptocurrencies), redirecting trade to Asia (not the blockchain), bringing production to land, and so on.

However, Roman Bieda, head of fraud investigations at the Coinfirm blockchain research platform, told Al Jazeera on March 1st that it was generally possible to use crypto to “avoid sanctions and hide wealth,” as has been done. from North Korea, Venezuela, and Iran.

But other experts told the publication that Russia’s case is different due to the scale of sanctions, its slow pace of cryptocurrency adoption and lack of market depth.

Ari Redboard, head of legal and government affairs at cryptocurrency investigator TRM Labs, said blockchain transparency was a natural deterrent to sanctioning the avoidance of sanctions in this case.

“Russia cannot use cryptocurrency to replace hundreds of billions of dollars that could potentially be blocked or frozen.

Cointelegraph reported on 25 February that ECB President Lagarde was eager for the cryptocurrency markets (MiCA) bill to be passed by the European Parliament as soon as possible to give the European authorities funds so that “cryptocurrencies can actually be captured. Lagarde called for urgent policies to prevent Putin from evading cryptocurrency sanctions.

In an interview with Rachel Madow on MSNBC this week, Hillary Clinton called on US President Joe Biden to ban Russia from trading in cryptocurrencies. She and Madou discussed threats to national security that could exist with regard to cryptocurrency, and Clinton said:

“I was disappointed to see some of the crypto exchanges, not all, but some of them refuse to stop transactions with Russia by some philosophy of libertarianism.”

Related: European Parliament postpones vote on cryptocurrency bill due to proof of work

Democratic Sen. Elizabeth Warren also took the opportunity on March 1 to condition that US financial regulators should check digital assets because they risk “allowing Putin and his associates to avoid economic pain.”

Fox News senior strategic analyst General Jack Keane discusses the Russian convoy heading to Kyiv and the huge number of Ukrainian refugees on the Polish border at Fox Business Tonight.

The United States, Canada, European allies and other countries have announced a crackdown on sanctions against Russia over its invasion of Ukraine, including cutting off Russian banks from the SWIFT messaging service, banning Russian planes, restricting business relations with Russian oligarchs and other measures. isolates the country economically.

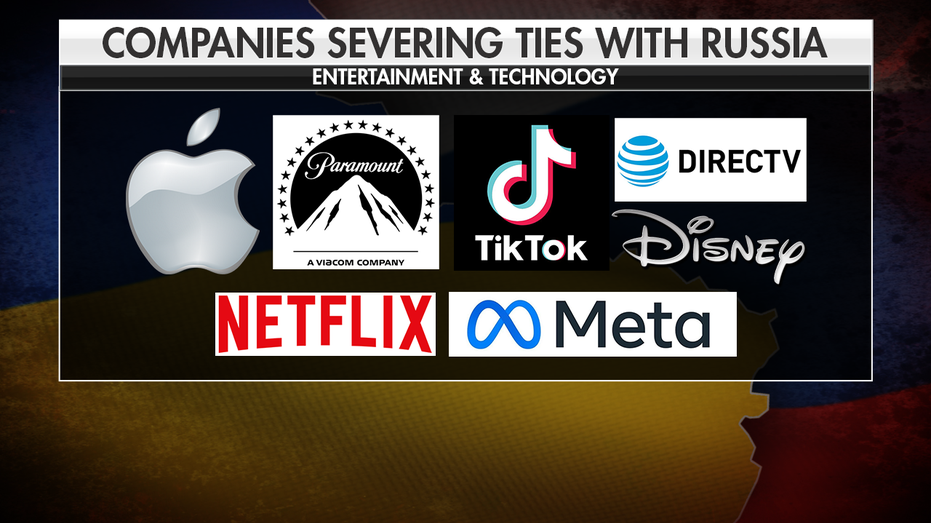

Several Western companies have since announced that they are severing ties with Russia, both as a result of these sanctions and because of their disapproval of the invasion of Ukraine.

BP announced on Sunday that it was leaving its 19.75% stake in Russian oil giant Rosneft and that two of BP’s current and former executives would leave the Russian company’s board.

“Russia’s attack on Ukraine is an act of aggression that has tragic consequences throughout the region,” BP chairman Helge Lund said in a statement. “This military action is a fundamental change. This led the bp board to conclude, after an in-depth trial, that our involvement with Rosneft, a state-owned company, simply could not continue. “

RUSSIA INVASES UKRAINE: LIVE UPDATES

Shell followed suit Monday, announcing it was severing ties with Gazprom, withdrawing its 27.5% stake in the Sakhalin II liquefied natural gas facility and withdrawing its stake in the nascent Nord Stream pipeline.

ExxonMobil was the last oil company to announce its exit from Russia on Tuesday night, the company said in a press release, saying it “fully complies with all sanctions” and “deeply saddened by the loss of innocent lives.”

Several companies, including Google, TikTok, YouTube, DirecTV and Meta, have restricted access to RT America, Russia’s state-run media, which the US State Department describes as a critical element in Russia’s “disinformation and propaganda ecosystem.”

Warner Bros., Disney and Sony Pictures are suspending the release of upcoming films in Russia.

WHILE THE RUSSIA-UKRAINE BUSY WAR, DIRECTV NIXES RT AMERICA FROM THE PROGRAM LINE

Apple has announced that it will stop selling all its products in Russia, including iPhone, iPad, Mac and other devices.

“We do everything possible for our teams [in Ukraine] and will support local humanitarian efforts, “Apple CEO Tim Cook tweeted last week.

Netflix has said it will not broadcast 20 Russian state television channels, which are required to be broadcast under Russian media law.

General Motors has suspended exports to Russia and said on Monday it was working to ensure the safety of its staff in the country.

Ford said Tuesday it was suspending all operations in Russia after the invasion of Ukraine “forced us to re-evaluate our operations in Russia.”

Tesla has no official presence in Russia, but the company announced this week that its charging stations in Poland, Slovakia and Hungary will be able to help evacuate Ukraine.

LATE THE RUSSIAN OLIGARS TO BE SHOCKED BY US SANCTIONS

Harley-Davidson announced on Tuesday that it was shutting down its business in Russia and cutting off all motorcycle supplies to the country.

Maersk, the world’s largest shipping company, said Russia’s invasion of Ukraine was already affecting the global supply chain and the company would suspend all supplies to and from Russia except food, medical and humanitarian goods.

“This exception is to emphasize that our company focuses on social responsibility and strives to support society despite all the complications and uncertainties within the current supply chain to / from Russia,” Maersk said in a press release on Tuesday.

GET FOX BUSINESS ON THE MOVE BY CLICKING HERE

The United Kingdom became the first nation on Tuesday ban all Russian ships from entering British ports.

Several airlines, including American Airlines, Delta Airlines and United Airlines, have suspended all incoming and outgoing flights to Russia.

Western companies are severing ties with Russia over the invasion of Ukraine, sanctions Read More »

FOX Business presenter Stuart Varney says Biden “has an ideal opportunity to increase pressure” as the Russian invasion continues.

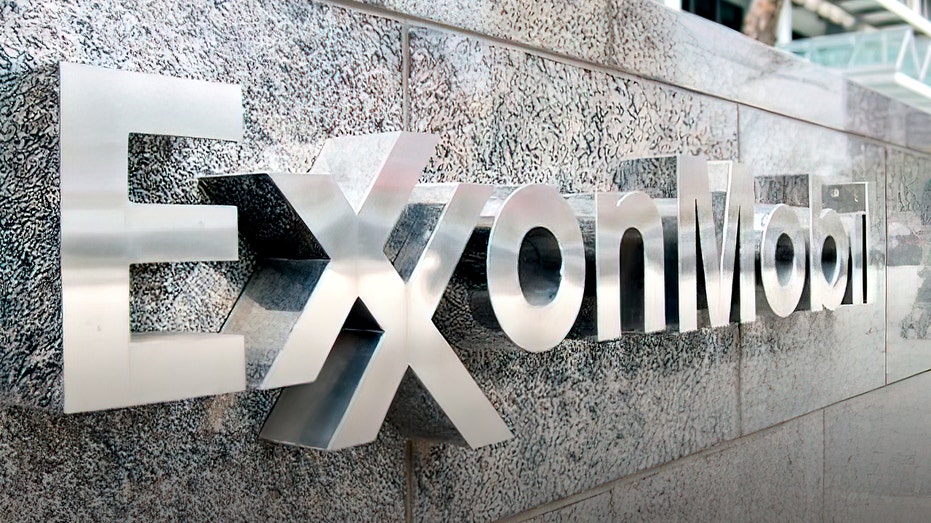

ExxonMobil said on Tuesday that it would suspend operations on a multibillion-dollar oil and gas project in Russia and suspend any new investment in the country.

The Sakhalin-1 project, a large oil and gas company on Sakhalin Island in far eastern Russia, is one of the country’s largest single foreign direct investments.

Exxon said it would launch a “carefully managed” exit from Sakhalin-1, the company said in a press release.

RUSSIA INVASES UKRAINE: LIVE UPDATES

ExxonMobil is headquartered in Irving, Texas. (iStock / iStock)

“As an operator of Sakhalin-1, we have an obligation to ensure the safety of people, the environment and the integrity of operations,” the company said. “Our role as an operator goes beyond capital investment. The process of terminating operations will need to be carefully managed and closely coordinated with partners to ensure that it is carried out safely.”

The American oil giant currently owns a 30% stake in the Sakhalin-1 project, together with the Japanese consortium SODECO, Indian ONGC Videsh Ltd. and two subsidiaries of Russian state oil producer Rosneft. Sakhalin-1 has an export capacity of 6.2 million tons per year, Politico reported.

“Given the current situation, ExxonMobil will not invest in new developments in Russia,” the company added.

TIMES SQUARE BILLBOARD CALLS BIDEN TO REJECT RUSSIAN OIL AGAINST WAR WITH UKRAINE

The company did not provide a schedule for when it plans to stop production. Energy companies are under greater pressure to withdraw or close down in Russia following President Vladimir Putin’s invasion of neighboring Ukraine.

Britain’s BP PLC, Shell and Norway’s Equinor ASA have previously said they plan to abandon their investments in Russia.

Russian President Vladimir Putin in Moscow, February 1, 2022 (Associated Press / AP Newsroom)

Exxon has already begun removing US nationals from Russia, Reuters reported earlier this week. The company hired more than 1,000 people across Russia last year.

YELEN SAYS G7 TO INCREASE FINANCIAL PRESSURE ON RUSSIA FOR “BRUTAL INVASION” IN UKRAINE

“ExxonMobil supports the people of Ukraine as they seek to defend their freedom and define their own future as a nation,” the company said. “We condemn Russia’s military actions, which violate Ukraine’s territorial integrity and threaten its people.”

A Polish border guard helps refugees from Ukraine when they arrive in Poland at the Korchova border checkpoint, February 26, 2022. (Associated Press / AP Newsroom)

In a press release, Exxon added that it was “saddened” by the loss of innocent lives during the Russian invasion of Ukraine. The company said it supported a “strong international response” to the conflict.

Exxon has been managing Sakhalin’s facilities since production began in 2005. The company has been developing its Russian oil and gas fields since 1995.

CLICK HERE TO READ MORE ABOUT FOX BUSINESS

Exxon is also developing plans to add a liquefied natural gas export terminal to the site, Reuters reported.

Jung Zhu Ji Kim, founder of the South Korean gaming company Nexon, has died at the age of 54.

On Tuesday, the Nexon holding company NXC issued a statement: “With deep sadness, Nexon mourns the unexpected death of its beloved founder, Jungju Jay Kim, who died in February.

His sudden death came as a big shock to the gaming industry in South Korea, which sees Kim as an icon and a pioneer. The company did not reveal the cause of death. According to press releasesKim has been treated for depression and his condition appears to have worsened. He is survived by his wife and two daughters.

Kim, who founded Nexon in 1994, pioneered free play space for computers and video games and launched the Massive Multiplayer Online Role-Playing Game (MMORPG) in 1996. Her popular titles include The Kingdom of the Winds, MapleStory, KartRider, Mabinogi and Dungeon & Fighter.

Kim stepped down as CEO of NXC after working for 16 years and handed over his position to JaeKyo Lee last year. Kim was considering selling his majority stake at NXC worth about $ 9 billion in 2019, but withdrew the sale because it could not find a suitable buyer.

Nexon, one of the world’s largest gaming companies, moved its headquarters from Seoul to Tokyo in 2005 and went public on the Tokyo Stock Exchange in 2011, raising more than $ 1 billion in the largest initial public offering for year in Japan.

“It is difficult to express the tragedy of the loss of our friend and mentor Jay Kim, a man who had an immeasurably positive impact on the world,” Nexon CEO and President Owen Mahoney said in a statement. “As a founder and visionary, Jay encouraged people around him to ignore skeptics and trust their creative instincts. He will be greatly missed by his family Nexon and many friends. ”

According to ForbesKim, South Korea’s third richest man by May 2021, has promised to donate $ 93 million to startups and children’s hospitals in 2018.

NXC diversified its crypto business by investing in South Korea’s first cryptocurrency exchange, Korbit, in 2017. The company has more than 45 live games in more than 190 countries.

Nexon Jung-ju founder Jay Kim has died at the age of 54 Read More »

Jeep, the iconic American brand owned by Stellantis, has revealed the first photos of its upcoming electric SUV. The company did not share any other details or even the name of the vehicle, but confirmed that the new EV will be launched in 2023.

Jeep is slower to adopt electrification than many of its competitors. The carmaker has released plug-in hybrid versions of its Wrangler and Grand Cherokee SUVs and is planning an off-road version of the Grand Cherokee, Trailhawk, which is also available with a hybrid engine.

But the unnamed SUV, due out next year, will be Jeep’s first all-electric battery-powered car. The carmaker recently announced that it will release zero-emission versions of all its vehicles by 2025, along with hybrid variants.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23280590/BU022_073EVv773e0olunq6hma4ja14svf977.jpg)

The new Jeep EV will be included in last year’s comprehensive plan of Stellantis, the multinational conglomerate that formed last year when Fiat Chrysler merged with France’s PSA Group to electrify the range of most of its brands. This includes EV versions of the Ram 1500 pickup and the Dodge electric muscle car.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23280591/ram_1500_bev_promo.jpeg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23280592/ram_1500_bev_rear.jpeg)

On Tuesday, Stellantis also annoyed the upcoming Ram 1500 truck with images showing the car’s lighting settings. The image seems to be just a design sketch, leaving open the possibility that Ram has not yet determined the final shape of his upcoming electric truck. Ram is also making an electric delivery van ProMaster, which will be included in Amazon’s fleet from 2023.

Both the Jeep EV and the Ram 1500 EV are likely to use Stellantis’ STLA platform, which is one of four platforms used by the carmaker for the upcoming range of electric vehicles.

As noted by Street showDaniel Golson, Stellantis has in fact left in some of the car’s design outlines a teaser image that shows more of the truck than the carmaker’s marketing team would probably prefer.

Ram has released two new teasers for the upcoming 1500 EV and they accidentally (?) Left a bunch of paths in the file that show more details about the design. Strangely, the roads weren’t scaled to actual sketches, so I just adjusted them to fit https://t.co/2rq4QNpuS2 pic.twitter.com/l0l1qDwyKM

– Daniel Golson (@dsgolson) March 1, 2022

Updated on March 1 3:47 PM ET: Updated to include a tweet from Daniel Golson.

Get the Insider app

Custom feed, summary mode and ad-free experience.

Download the application

Close icon Two crossed lines that form an “X”. Specifies how to close an interaction or reject a notification.

Most international shipping is controlled by only three cooperative alliances.

The White House says consolidation has led to higher freight tariffs that boost inflation.

A new federal initiative will use antitrust laws to promote competition in shipping.

Charging Something is loading.

Expensive shipping costs are the target of a new initiative announced by the White House on Monday, which ordered the Justice Department to use antitrust laws to make the largest companies in the industry more competitive with each other.

Approximately 80% of all global shipping capacity – and 95% of east-west trade – is controlled by three alliances that allow freight companies to coordinate tariffs and schedules.

This consolidation largely went under the main radar until the pandemic completely disrupted the global supply chain. Ocean carriers have responded to increased demand and reduced supply by raising tariffs on freight between Asia and the United States by more than 1,000 percent.

As transportation costs rise, consumer prices are also rising, and White House experts estimate that shipping will add a full percentage point to inflation next year.

And it’s not just consumers who remain paying more – exporters are complaining that large companies are not shipping American products to foreign markets.

Some carriers apparently find it more cost-effective to ship empty containers back to Asia for refueling instead of transporting US agricultural goods to other ports.

These rising prices were good for shipping companies’ profit margins, rising to 56% in the third quarter of 2021, from 3.7% in 2019.

For President Biden, such hefty profits in such a low-margin historical business are evidence of anti-competitive practices. He plans to address the issue during a speech on the state of the Union on Tuesday night.

Under the new initiative, a regulatory agency known as the Federal Maritime Commission will coordinate with the Department of Justice to identify and prosecute violations under the Shipping and Basic Antitrust Act, the Sherman Act and the Clayton Act.

“Competition in the maritime industry is an integral part of lowering prices, improving the quality of services and strengthening the sustainability of the supply chain,” Attorney General Merrick Garland said in a statement. “Violators of the law need to know that the Ministry of Justice will provide the Federal Maritime Commission with all the necessary support for litigation, as it is pursuing its mission to promote competition in ocean shipping.

This increased control of the shipping industry follows weeks of political announcements accusing corporate greed of worsening inflation. Other sectors that fall under the microscope include beef producers and oil companies.

The White House is targeting shipping alliances for antitrust enforcement Read More »

Despite their lowest levels in the last minutes of trading, US stocks closed lower on Tuesday after Russia strengthened intensifies its invasion of Ukraine, pushing oil prices above $ 100 a barrel and lowering government bond yields.

Dow Jones decreased by 1.8%and the S&P 500 decreased by 1.6%and Nasdaq decreased by 1.6%.

Looking at the preliminary closing figures, the Dow Jones Industrial Average fell 597.65 to 33,294.95. The S&P 500 fell 67.68 to 4,306.26. Nasdaq withdrew 218.94 to 13,532.46.

Showing the broad weakness that marked trade, 10 of the 11 industrial sectors of the S&P 500 ended in the red, led by a 3.7% decline in financial performance. Energy was the only stubborn one, with higher oil prices sparking a new rally in the sector.

Yields on 10-year bonds fell 11 basis points to 1.73%. The 2-year yield withdrew by about 8 basis points to 1.35%.

Crude oil rose 8.7 percent to $ 104.39 a barrel, gold rose 2.4 percent to $ 1947 an ounce; wheat futures rose 5.4% to 984 cents a bushel.

Military action in Ukraine and a number of economic sanctions against Russia are on the brink of investors. In his note on the stock market positioning model, Citi analyst Chris Montagu wrote: “Investors are becoming less short in most markets … US futures positioning has expanded and unilaterally short for the Nasdaq 100 and lower for the Nasdaq 100. S&P 500.

As the Russia-Ukraine conflict looms over the world economy and threatens to thwart the US economic recovery, traders have dropped expectations of raising interest rates by 50 basis points at the Fed’s March 15-16 meeting. The probability of rising by 25 bps now stands at 92% against 58.6% a week ago, according to the CME FedWatch Tool. One week ago, the probability of a 50 bps rise was 41%; is now at 0.

The report on jobs in February, due to be published on Friday, may change that. “While most now expect the Fed to raise interest rates by just 25 basis points next month, a hotter-than-expected Friday job report could increase the chances of moving by 50 basis points,” said Anthony Saglimbene, global market strategist at Ameriprise. Bloomberg.

Russia has previously retaliated against Western sanctions; The Moscow Stock Exchange is still closed

Nasdaq, S&P 500 and Dow Jones fall as conflict in Ukraine sparks oil spike Read More »