Target, Kroger, Foot Locker and others

Shopping cart seen at Target store in Brooklyn, New York, USA, November 14, 2017.

Brendan McDermid Reuters

Shopping cart seen at Target store in Brooklyn, New York, USA, November 14, 2017.

Brendan McDermid Reuters

See the companies leading titles in the lunch trade.

Target – The retailer’s shares jumped 11% after the company reported 9% sales growth in the fourth fiscal quarter, despite pressure from the supply chain, and said it was ready to maintain this momentum. Target has also issued guidelines for low- to medium-digit earnings growth and predicts adjusted earnings per share will increase with high single-digit numbers next year.

Kroger – Kroger shares rose more than 2% after Telsey rebuilt the grocery chain before its earnings report. “We believe we have greater visibility and confidence in Kroger’s multi-channel multi-channel growth track,” said Joseph Feldman of Telsey.

Foot Locker – The athletic retailer said shares fell 7.5 percent after Goldman Sachs downgraded shares to neutral from buying, saying it saw too much short-term pressure on stocks. The decline was followed by Foot Locker’s announcement that it would sell fewer Nike products.

AutoZone – Retail stock fell 2%, although AutoZone exceeded earnings and revenue expectations for the second fiscal quarter. The company’s sales in the same store jumped 13.8% year on year.

Workday – Shares of Workday rose 7% in lunchtime trading after surpassing the top and bottom lines of quarterly earnings. The company also raised its subscription revenue targets for fiscal 2023 to range from $ 5.53 billion to $ 5.55 billion, up 22% from a year earlier.

Lucid Group – Electric carmaker shares fell more than 15% in lunch trading after reporting a larger-than-expected loss of 64 cents a share, while analysts expected a loss of 25 cents a share, according to Refinitiv. Revenue reached $ 26.4 million, below the estimated $ 36.7 million.

Zoom Video – Shares of Zoom fell nearly 4% at noon after the video conferencing platform issued weaker-than-expected guidance for the first quarter and full year. The company exceeded expectations for profits and revenues for the fourth quarter.

Novavax – Shares of Novavax rose 2.7% at noon. The biotech company reported a gap in the top and bottom lines in the fourth quarter, but said it expects revenue of between $ 4 billion and $ 5 billion in 2022. Novavax is also working on an omicron-specific vaccine.

JM Smucker – Shares of JM Smucker fell 6.3% despite better-than-expected earnings. The company reduced its sales growth guidelines for the fiscal year and reduced the high end of its fiscal year revenue guidelines.

Hormel Foods – Hormel shares rose 4% after the company surpassed revenue forecasts in its latest quarterly report. Hormel’s profits are in line with Wall Street’s expectations.

Rivian – Rivian shares fell 8.5% after Wells Fargo reaffirmed its equal share rating. The company said it saw too many “high-speed winds”.

Chevron – Shares of Chevron rose 3.5% after Bank of America reaffirmed its rating to buy the shares. The call came after Chevron said it was close to acquiring Renewable Energy Group.

Wells Fargo, Bank of America – Financial stocks were among the biggest losers on Tuesday. Bank of America fell more than 4%, while Wells Fargo fell about 5%. Falling government bond yields could potentially bite banks’ profits, while the conflict in Eastern Europe and sanctions against Russia have led some traders to worry about credit crunch.

Occidental Petroleum, APA Corp – Energy stocks rose as oil prices soared as US crude reached its highest level since June 2014. Occidental Petroleum added 5.8% and APA Corp rose 4.6% .

Lockheed Martin, Northrop Grumman – Defense stocks have risen as investors have watched rising tensions in the Russia-Ukraine conflict. Lockheed Martin rose 4.3%, while Northrop Grumman added 2%.

– CNBC’s Maggie Fitzgerald, Jesse Pound and Samantha Subin contributed to the report

Colgate toothpaste display on store shelf in Westminster, Colorado, April 26, 2009. REUTERS / Rick Wilking / Files

I’m registering

March 1 – Get ready for a $ 10 toothpaste tube.

Colgate-Palmolive Co. (CL.N) CEO Noel Wallace told an industry conference last week that the household goods maker sees its new Optic White Pro toothpaste as a premium product, “vital” for its ability to raise prices. which will help increase profits this year.

His remarks come as many consumer product companies raise prices as much as they can to offset their own rising costs, a trend that could continue due to the Russia-Ukraine conflict, whose economic risks include rising gasoline prices. Read more

I’m registering

So far, retailers and consumers appear to be largely indifferent to higher prices. But some lawmakers and consumer advocates say companies are raising prices excessively to boost profits and return money to shareholders.

“We are seeing significant increases in the prices of almost every item that consumers buy,” said US spokesman David Sicillin, who is working on proposed antitrust legislation aimed at reducing prices. “They cause real difficulties. People take things out of their food carts because it’s too expensive.”

In the past, large retailers such as Walmart Inc (WMT.N) have repulsed rising prices. But now retailers like Walmart and Target Corp.

Target said in a profit talk on Tuesday that rising prices are the last lever he pulls when faced with increased costs. Read more

The US Federal Trade Commission has been investigating the incredible prices and supply chain disruptions for the past three months, requiring companies including Procter & Gamble, Kraft Heinz Co. (KHC.O), Kroger Co (KR.N) and Walmart to hand over domestic documents for profit margins, prices and promotions.

Comments on the inquiry are due by March 14 and so far show that small grocers are angry that they need to pay more and receive less important products. Consumers wrote that they could not find oatmeal, cereals and cat food.

In an interview with Reuters, Cicilline cited Colgate as an example of a company that advertises price increases, makes basic items too expensive and pays more to investors.

Colgate expects its margins to increase this year, in part due to higher prices. He also bought almost 50% more shares last year, which is an advantage for investors.

Rising prices are a “key capability” for Colgate that will help boost profits, Wallace said last week.

A Colgate spokesman said in a statement that the company has a wide portfolio of products at various price points and advertised its new $ 10 toothpaste as the first with 5% hydrogen peroxide, with “demonstrated efficacy for teeth whitening.”

Consumer goods companies began raising prices last year in response to rising raw material costs and labor shortages due to the pandemic. Read more

“There is an incredible appetite for our products,” said Katie Dennis, a spokeswoman for the Consumer Brands Association, a trading group for consumer packaging companies, including Colgate. “We do the most important things. And there is no option not to deliver them.”

Prices have also risen on competing private label items, analysts said.

The White House is focused on corporate profits as it fights inflation. Bharat Ramamurti, deputy director of the White House National Economic Council, said there were examples of companies outside the meat packaging industry – which is especially in the White House’s field of vision – raising prices beyond their own expense. Read more

Lindsay Owens, executive director of the progressive nonprofit Groundwork Collaborative, called diapers a low-competitive category, paving the way for aggressive price increases.

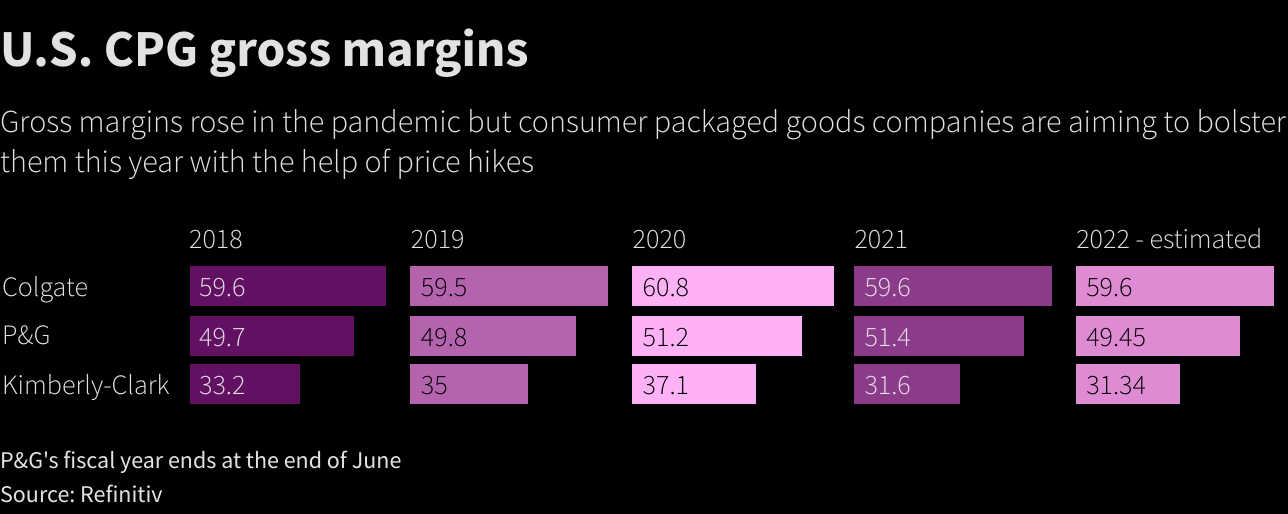

The margins of Kimberly-Clark Corp. (KMB.N) declined in 2021 due to rising costs. Diaper maker Huggies is betting that consumers will buy more expensive options made with plant materials, which will help its profits recover, conference executives said last week.

P&G executives said last week that they expect margins to continue to improve as higher prices hit stores. The company also plans to buy back more shares than originally planned. Read more

Reuters Graphics

“Many companies are taking advantage of high consumer demand to keep raising prices when not needed,” said Jack Gillis, executive director of the Consumer Federation of America, a nonprofit group. “As long as consumers are willing to pay these prices, there is no incentive to lower them.”

I’m registering

Report by Jessica DiNapoli in New York; Edited by Leslie Adler and Andrea Ritchie

Our standards: ‘ principles of trust.

An investment fund backed by Russian oligarchs sanctioned by the European Union since the invasion of Ukraine has ties to Teneo, an influential corporate consulting firm based in the United States.

The public relations and strategy giant was hired in 2020 by LetterOne, a Luxembourg-based private investment company that counts sanctioned billionaires Mikhail Friedman, a native of Ukraine, and Peter Aven as co-founders. The deal, seen by CNBC, appears to have paid Teneo more than $ 3.6 million to arrange interviews and consultations on US media strategy.

LetterOne was founded by Friedman, Aven, Alexei Kuzmichev, Andrei Kosogov and German Khan – all of whom are some of the richest business leaders based in Russia. All five founders were on the board of LetterOne, with Friedman as chairman, according to data from PitchBook, reviewed by CNBC. The executives started the company in 2013 after founding Alfa Group, one of the largest conglomerates in Russia.

Friedman and Aven were accused by the EU of having ties to Russian President Vladimir Putin, allegations denied in a statement to CNBC. The statement did not answer any of CNBC’s questions about LetterOne’s work with Teneo or how the investment fund plans to move forward now that two of its founders have been sanctioned. Friedman’s bank, Alpha Bank, is also sanctioned by the United States. He called for an end to the Russian invasion of Ukraine.

After CNBC asked a LetterOne spokesman Monday about their business, including their relationship with Teneo, several pages of their website, including the “our people” section, appear to have been deleted since Tuesday morning. An error message now appears in this section, which lists the founders and CEOs of the company. The LetterOne board section is still active, but no longer shows Friedman and Aven as board members.

Joshua Hardy, a spokesman for LetterOne, said Friedman and Aven had retired on Tuesday. CNBC first contacted the private investment company on Monday.

Although the emails to Teneo were not returned, Kathleen Lacey, senior managing director of the company, which was listed in the document as working with the LetterOne account, told CNBC in a brief phone call Monday that they are no longer one of its customers and believe he no longer represented them in her company.

The FARA division of the Department of Justice, which oversees lobbying and consulting work in the United States for foreign representatives, told CNBC on Tuesday that it believes the agreement between Teneo and LetterOne “remains active.”

LetterOne has multiple ties to Teneo, which was founded by two Democrat advisers who worked for former presidents Bill Clinton, Barack Obama and former Secretary of State Hillary Clinton. The private equity firm has been involved in nearly a dozen deals valued at more than $ 1 billion, according to PitchBook. Uber, for example, made a $ 200 million investment from LetterOne in 2016.

Since then, Teneo has become a consulting giant with past clients, including Dow Chemical and Coca-Cola. Foreign clients include Neom, a company that has backed a huge public investment fund to create a metropolis in Saudi Arabia, and a foundation run by the Princess of the Emirates.

Their senior advisers listed include political and business leaders, including former Republican Speaker Paul Ryan, former IBM CEO Ginny Rometti, former Dow Chemical CEO Andrew Liverris, and Harvey Pitt, former Commission Chairman. securities and stock exchanges.

Doug Band, once one of Bill Clinton’s closest associates, founded Teneo with Declan Kelly and Paul Curry. Kelly served as Special Envoy for Northern Ireland to the Obama administration and helped Hillary Clinton run for president in 2008. Since then, Bend and Kelly have left the company, with the latter stepping down as Teneo’s chief executive after reports that he was drunk and behaving inappropriately at an event organized by the non-profit organization Global Citizen. Kiri became CEO after Kelly’s resignation.

A contract between Teneo and LetterOne, reviewed by CNBC, shows that the consulting firm was hired in 2020 for $ 150,000 a month to advise the fund on their media strategy. Under the agreement, Teneo was expected to “provide strategic and engagement advice to the company’s stakeholders and board members (including, but not limited to, scheduling media interviews, assisting with media briefings, coordinating stakeholder engagements and related activities) ‘.

Under the contract, LetterOne was on track to pay Teneo more than $ 3.6 million as of September 2020. There were at least four Teneo representatives working on the account, according to other documents filed with the Justice Department.

Additional documents show that last year Teneo took credit for its attempts to arrange interviews for LetterOne leaders with producers and TV presenters, including those at CNBC, Bloomberg and Fox Business. A document shows that a Bloomberg representative has been connected almost a dozen times to see if LetterOne can sponsor one of their Bloomberg Invest events.

There are other connections between Teneo and LetterOne.

The non-executive chairman of LetterOne is Evan Davis, a British businessman who was once the UK’s Secretary of State for Trade, Investment and Small Business. He is also a senior advisor at Teneo.

VEON, a telecommunications company operating in Russia and Ukraine, is listed on the LetterOne website as one of its active investments. Ursula Burns was chairman of VEON for almost three years before retiring in 2020. She later became chairman of Teneo.

VEON, meanwhile, announced on Tuesday that Mikhail Friedman had resigned from their board.

A Russian-backed investment fund affiliated with an American corporate consulting firm Read More »

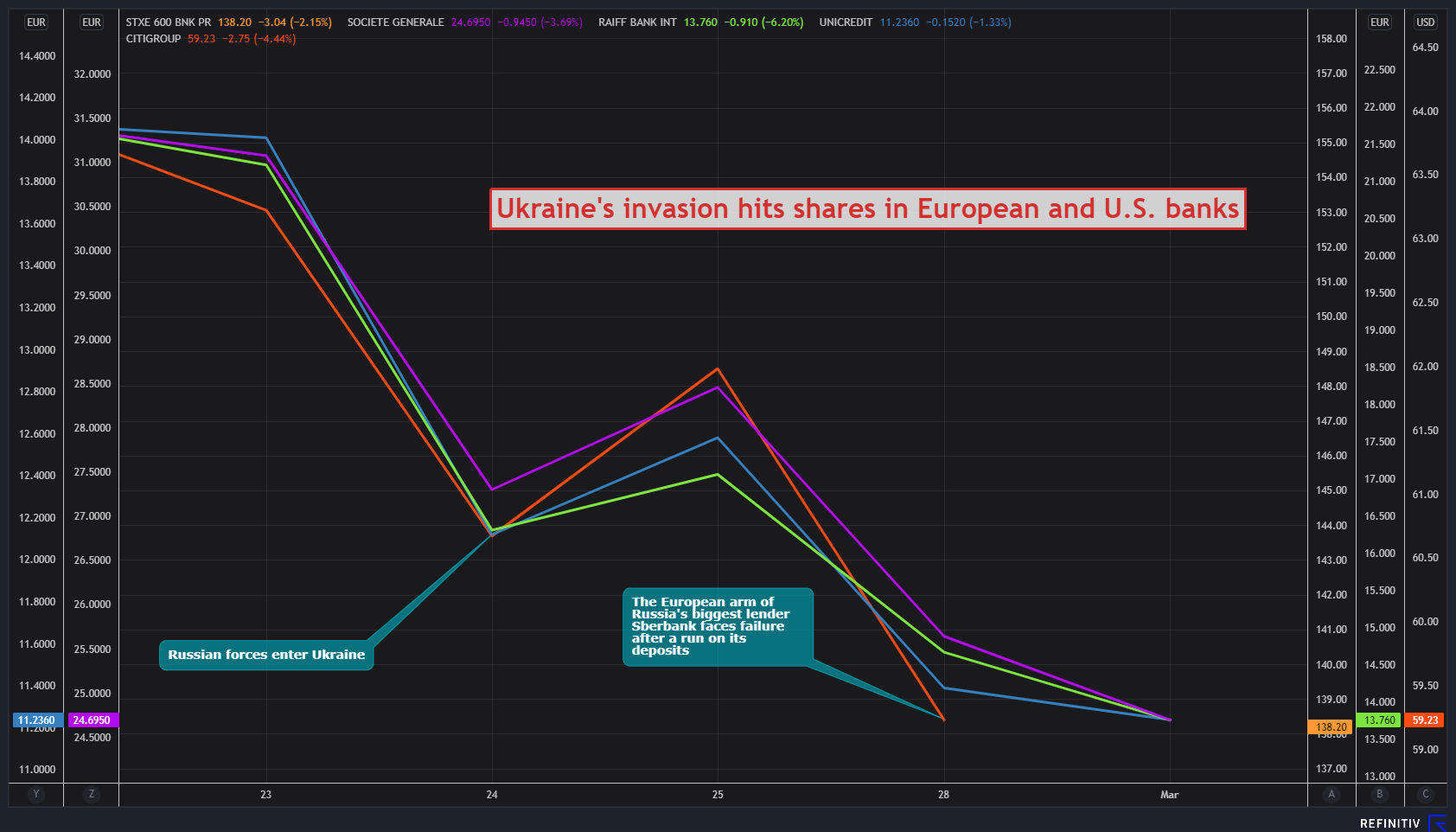

MILAN, March 1 – The latest wave of sanctions against Russia over its invasion of Ukraine has plunged the global banking industry even deeper into turmoil as Western countries try to squeeze Moscow’s access to money for its economy and international trade.

Some Russian banks will be excluded from the international payment system SWIFT, and most importantly, other sanctions have been targeted at the country’s central bank to prevent it from using its foreign reserves. Read more

The moves are intended to undermine Moscow’s ability to withstand broader economic sanctions, but also affect Western banks that are exposed to the Russian economy.

I’m registering

Sberbank’s European arm (SBER.MM), Russia’s largest lender, is facing failure, the European Central Bank said after a reduction in deposits caused by the crisis. Read more

In Europe, Italian and French banks have the largest exposures in Russia, with just over $ 25 billion each at the end of September, followed by Austrian banks with $ 17.5 billion, according to the Bank of International Settlements (BIS).

The exposure of American banks amounts to 14.7 billion dollars, according to BIS.

Here are some of the banks with significant Russian exposure.

Russia’s invasion of Ukraine is hitting the shares of banks exposed to the country

US BANKS

CITIGROUP INC (CN)

The US bank said on Monday that its total exposure to Russia was close to $ 10 billion.

Citigroup ranked Russia as 21 among its 25 largest exposures in countries with $ 5.4 billion in loans, securities and financing commitments at the end of 2021 – 0.3% of total exposures based on regulatory documentation.

On Monday, Citigroup gave more details, counting “total third-country exposure” to $ 8.2 billion. This includes $ 1.0 billion in cash at the Bank of Russia and other financial institutions and $ 1.8 billion in reverse repo transactions.

Citigroup also said it has $ 1.6 billion in exposures to additional Russian counterparties outside its Russian subsidiary that are not included in the $ 8.2 billion. Read more

By comparison, Goldman Sachs Group Inc (GS.N) reported $ 293 million in net exposure to Russia last month, as well as a total of $ 414 million in market exposure as of December 2021.

EUROPEAN BANKS

RAIFFEISEN BANK INTERNATIONAL (RBI) (RBIV.VI)

The Austrian lender’s Russian business ranks as the country’s ninth largest bank in terms of loans. With total assets of 15.8 billion euros, it employs about 8,700 employees to serve more than 4.5 million customers.

Its equity of € 2.4 billion represents 18% of consolidated capital.

RBI has been operating in Russia since the collapse of the Soviet Union, and its business there contributed nearly a third of the group’s net profit of 1.5 billion euros ($ 1.66 billion) last year. Read more

RBI’s exposure in Russia totals 22.85 billion euros, more than half of which is related to the corporate private sector, according to a presentation of its 2021 results.

Russia’s central bank accounts for 8% of RBI’s exposure to the country, government entities 4% and Russian banks 2%, according to the performance.

The total figure includes 11.6 billion euros in customer loans (or 11.5% of the group), more than 80% of which are in Russian rubles.

The cross-border exposure to Russia is only 1.6 billion euros without parental funding from Vienna. Raiffeisen also holds 2.2 billion euros in loans to Ukrainian customers.

Provisions against losses cover 64.3% of RBI’s impaired exposures in Russia.

RBI CEO Johann Strobl told Reuters this week that the group’s Russian subsidiary “has a very strong liquidity position and (was) registering inflows”.

SOCIETE GENERALE (SOGN.PA)

Societe Generale began doing business in Russia in 1872, then left the country in 1917, the year of the Bolshevik Revolution, to return in 1973. It has 1.5 million local customers.

Societe Generale, which controls Russia’s Rosbank, had a total of 18 billion euros in exposure to Russia at the end of last year – or 1.7% of the group’s total.

This includes both on-balance sheet and off-balance sheet items (for example, a credit line that has not yet been used).

Of SocGen’s Russian exposure, 39% is to the corporate sector and 36% to retail. Sovereign entities represent 21%, financial institutions – 4%.

Real loans rose 13.3% last year to 10.5 billion euros.

Its Russian retail business – for which an average of € 1.05 billion in capital was allocated last year – generated € 115 million in net profit in 2021, compared to € 37 million in 2020. Including financial services, the net profit of SG Russia was 152 million euros, compared to 76 million in 2020.

The bank said it had implemented measures to adapt to the new sanctions and that Rosbank continued to operate in a “safe manner”.

UNICREDIT (CRDI.MI)

The Russian subsidiary of the Italian bank ranks as the 14th largest bank in the country. UniCredit Russia’s equity of € 2.3 billion represents 3.7% of the group’s total volume.

UniCredit’s default exposure related to Russia totaled € 14.2 billion by mid-2021

Of these, about 8 billion euros are loans granted by Russian hands and financed at the local level.

The rest includes off-balance sheet positions and cross-border loans, granted mainly by UniCredit SpA to large corporations outside Russia.

UniCredit said last week that its Russian franchise accounts for only about 3% of the group’s revenue, and provisions cover 84% of its non-performing exposures.

INTESA SANPAOLO (ISP.MI)

Italy’s largest bank is financing major investment projects in Russia, such as the Blue Stream gas pipeline and the sale of a stake in oil producer Rosneft (ROSB.MM). It handles more than half of all trade transactions between Italy and Russia.

Intesa’s loan exposure to Russia is 5.57 billion euros at the end of 2021, or 1.1% of the total.

Its subsidiaries in Russia and Ukraine have assets of € 1 billion and € 300 million, respectively, which together represent only 0.1% of the group’s total assets.

ING (INGA.AS)

The Dutch bank has about 4.5 billion euros in outstanding loans with Russian customers and about 600 million euros with customers in Ukraine, from a total credit book worth more than 600 billion euros.

ING said many sanctions against Russia have been in place since 2014.

(1 dollar = 0.9016 euros)

I’m registering

Additional reports by Brena Hughes Negavy in Zurich, Toby Stirling in Amsterdam, Alexandra Schwartz-Görlich in Vienna, Elizabeth Dilts in New York; edited by John O’Donnell, Andrew Havens and Jane Merriman

Our standards: ‘ principles of trust.

Explanation: Which international banks are exposed to Russia? Read More »

US stocks plummeted on Tuesday to mark another volatile day on Wall Street as investors assessed intensifying Russian attacks on Ukraine and the attack on new Western sanctions against the possibility of geopolitical uncertainty to divert the Federal Reserve from its aggressive first strike. rates.

The S&P 500 fell 1.7% to its lowest session value of 4,299.97, and the Dow Jones Industrial Average fell 2.1% to 33,166.98. The Nasdaq Composite also fell 1.6% to 13,525.98. The 10-year US public finance index fell to 1.7%. The last trading day in February on Monday marked the worst start of the year for the Dow and S&P 500 since 2020. The Nasdaq, which has now fallen 12.1% since the beginning of the year, recorded its worst January and February of 2009 this year.

WTI crude, meanwhile, jumped 10 percent to a high of $ 105 a barrel, marking its highest price since 2014 amid worries about a collapse in the energy sector.

Russia’s economy was in the spotlight on Monday as tougher sanctions by the United States and European allies on its invasion of Ukraine shook the country’s financial system and led to a 30 percent drop in the ruble.

US and European measures, including a move to block some Russian banks from the SWIFT payment network and sanctions against Russia’s central bank, have already dealt a heavier-than-expected blow to the country’s economy, testing decades of efforts by President Vladimir Putin to to make the system resistant to sanctions.

The United States, the European Commission, France, Germany, Italy, the United Kingdom and Canada issued a joint statement Saturday launching selected Russian banks from SWIFT, a network that works to facilitate trillions of dollars in global transactions.

On Monday, the United States also banned Americans from doing business with the Central Bank of the Russian Federation, the National Wealth Fund of the Russian Federation and the Ministry of Finance of the Russian Federation. Western financial institutions are expected to follow suit, with HSBC limiting its dealings with a number of Russian banks, including the second-largest VTB.

The story continues

The crisis between Russia and Ukraine “will create great pain and damage the Russian economy,” Virginia Sen. Mark Warner told Yahoo Finance Live on Monday. “This is a much bigger economic blow than Putin expected.”

As investors watch the escalation of the crisis abroad in the United States, they turn their attention back to the Federal Reserve and its plan to raise interest rates this month.

Sky-high inflation footprints on a monthly basis have raised fears among market participants that central bank employees will raise short-term borrowing costs more aggressively than expected to mitigate rising prices, even fueling the possibility of doubled interest rates by 50 basis points. mid-March. But with uncertainty about how the Russia-Ukraine turmoil will unfold, Fed observers expect the central bank to take a slight rise in interest rates.

“Given the current conflict in Ukraine, significant short-term uncertainty remains with the central bank’s intentions,” LPL financial strategists Lawrence Gillam and Ryan Detrick said in a note, adding that pressure to raise oil and other commodity prices and sanctions against Russia could have wider economic consequences. “As such, inflationary pressures may remain high, especially when it comes to gas prices.

And yet, like many Fed observers, the LPL has raised its price for the first time from 25 basis points this month – so far.

“As long as there is some kind of deal or the violence does not subside in Ukraine, the markets will remain at increased risk and Powell will look to be a little more careful,” Sputting Rock Asset Management chief strategist Rhys Williams told Yahoo Finance Live.

–

These were the main movements of the markets during the lunch trade

S&P 500 futures (ES = F): -72.70 points (-1.66%), to 4301.24

Dow futures (YM = F): -696.50 points (-2.06%), to 33,196.10

Nasdaq futures (NQ = F): -201.44 points (-1.44%) to 13,549.96

raw (CL = F): + $ 10.54 (+ 11.01%) to $ 1106.26 per barrel

gold (GC = F): + $ 34.50 (+ 1.82%) to $ 1935.20 per ounce

10-year treasury (^ TNX): -14.44 bps to 1.695% yield

–

Construction costs in the United States jumped in January amid high costs for single-family housing and private non-residential structures.

The Ministry of Trade reported a 1.3% increase in construction and revision costs on December data, which reflected that construction costs rose by 0.8% instead of the originally reported 0.2%.

Bloomberg’s consensus data show that economists expect 0.1% cost recovery.

Housing construction remains under pressure from higher construction material costs despite the jump in January. The National Association of Home Builders said last month that failures in the production of building materials inflated construction prices and delayed projects.

–

Production activity in the United States rose more than expected in February as COVID-19 infections declined. However, factory employment has slowed, exacerbated supply chain disruptions and put upward pressure on commodity prices.

The latest footprint of the Institute of Supply Management (ISM) for its national factory index rose to 58.6 last month from 57.6 in January, the lowest figure since November 2020.

A figure above 50 indicates an expansion in production, which represents 11.9% of the US economy. Economists polled by Bloomberg expected a footprint of 58.0.

–

Kohl’s Corp. (KSS) missed analysts’ forecasts for the fourth quarter, but reported an optimistic revenue outlook for 2022 and said it would “reward its momentum” this year.

The company recorded a 13% drop in fourth-quarter net profit to $ 299 million for the quarter ended January 29, 2022, from $ 343 million in the same period a year ago.

Although declining on a quarterly basis, net annual income jumped to $ 938 million, compared to a loss of $ 163 million in 2020 due to the pandemic. Earnings per share reached a record high of $ 7.33 in 2021.

Meanwhile, the company said it was committed to unsolicited bidders. Kohls is under pressure from activist investors, including Macellum Advisors and Engine Capital, to increase shareholder value and improve its financial performance, and also called for the company to be split into separate online and ordinary businesses, the retailer said. rejected.

Shares of Kohls rose 4.48% to $ 58.11 per share at 9:59 a.m. ET.

SAN RAFAEL, CALIFORNIA – JANUARY 24: The Kohl logo is displayed on the exterior of a Kohl store on January 24, 2022 in San Rafael, California. Kohl’s retailer received an unwanted takeover bid worth $ 9 billion from activist investor Starboard Value through Acacia Research Corp. The offer is for $ 64 per share compared to the last closing price of $ 46.84 per share on Friday. (Photo by Justin Sullivan / Getty Images)

–

Shares of Target (TGT) jumped 14% at opening, after the company reported better-than-expected prospects for its annual adjusted earnings per share.

The retailer shattered analysts’ fourth-quarter profit forecasts as consumers sought clothing and food deals amid rising inflation.

“The quarter was driven by traffic. This means that users voted with their feet and clicks and chose Target more often. So this is an incredibly healthy sign for our business, “said Target CFO Michael Fidelke at Yahoo Finance Live.

The target rose 11.42% to $ 222.59 per share at 9:47 a.m. ET.

–

Here’s how the markets opened for Tuesday’s trading session:

S&P 500 futures (ES = F): -11.34 points (-0.26%), to 4,362.60

Dow futures (YM = F): -169.64 points (-0.50%), to 33,722.96

Nasdaq futures (NQ = F): -46.40 points (-0.34%) to 13,705.00

raw (CL = F): +5.39 dollars (+ 5.63%) to 101.11 dollars per barrel

gold (GC = F): + $ 19.50 (+ 1.03%) to $ 1920.20 per ounce

10-year treasury (^ TNX): -6.0 bps to 1.779% yield

–

Here’s how the Wall Street key performance contracts presented themselves before Tuesday’s opening:

S&P 500 futures (ES = F): -38.00 points (-0.87%), to 4330.00

Dow futures (YM = F): -258.00 points (-0.76%), to 33,582.00

Nasdaq futures (NQ = F): -132.25 points (-0.93%) to 14,095.75

raw (CL = F): +3.75 dollars (+ 3.92%) to 99.47 dollars per barrel

gold (GC = F): + $ 22.70 (+ 1.19%) to $ 1923.40 per ounce

10-year treasury (^ TNX): 0.00 bps to receive 1.839%

–

Here are the main movements in the markets before overnight trading on Monday:

S&P 500 futures (ES = F): +3.75 points (+ 0.09%), to 4371.75

Dow futures (YM = F): +20.00 points (+ 0.06%), up to 33,860.00

Nasdaq futures (NQ = F): -9.50 points (-0.07%) to 14,218.50

raw (CL = F): + $ 0.16 (+ 0.17%) to $ 95.88 per barrel

gold (GC = F): + $ 8.80 (+ 0.46%) to $ 1909.50 per ounce

10-year treasury (^ TNX): -14.7 bps to 1.822% yield

White House spokeswoman Jen Psaki listens to Dalip Singh as deputy national security adviser on international economics , USA, February 24, 2022. REUTERS / Leah Millis

–

Alexandra Semenova is a reporter for Yahoo Finance. Follow her on Twitter @alexandraandnyc

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboardand LinkedIn

Shares open as Russia intensifies attacks on Ukraine Read More »

Zoom in / One of Waymo’s Jaguar I-Paces on the streets of San Francisco.

Zoom in / One of Waymo’s Jaguar I-Paces on the streets of San Francisco.Waymo

Waymo’s walks in San Francisco will soon start costing money, according to TechCrunch. Alphabet’s division of robotaxi has received the necessary permission from the California Utilities Commission, which allows it to charge customers for their trips, something that should start happening later in March.

Initially, Waymo began training his ax-robot to drive across the flat, sunny latitudes of Chandler, Arizona. And in October 2020, the company finally started offering a real commercial transport service in the area.

Ironically, there are limitations to the lessons you can learn in such a car-oriented environment. Autonomous vehicle training is about extreme management, and there are many more in San Francisco’s dense, chaotic, pedestrian-filled environment than in the Arizona suburbs.

In the fall of 2021, Waymo successfully applied for a deployment permit from the California Department of Motor Vehicles. Until then, the startup robotaxi had a testing permit issued for the first time in 2014. This allowed it to test its autonomous vehicles on public roads, first with a safety driver on board, and then in 2018 without this person on site. of the driver. But Waymo could not carry passengers.

Waymo’s DMV permit allows the company to operate in parts of San Francisco and San Mateo counties, even in light rain and light fog and at speeds up to 65 mph (105 km / h).

But this implementation permit alone was not enough to start commercial operations – it also required CPUC approval. And now Waymo has that, although customers who welcome travel to San Francisco will find that they share the cabin with a human safety operator under the terms of the permit.

Waymo will soon start asking San Francisco riders to pay for travel Read More »

A black woman accused Delta Air Lines of discrimination after a flight attendant allegedly asked her to move to the back of a plane to make room for two white women.

Camille Henderson said she was sitting near the window of row 15 during a Feb. 3 flight from Atlanta to San Francisco when women sitting in the aisle and middle seats next to her said they had first-class tickets. ABC 7 reported.

“They felt they had first-class tickets, but they couldn’t get the tickets,” Henderson told the news agency, adding that the women had continued to complain for more than an hour.

Henderson recorded part of the exchange between the women and the flight attendant.

“Unfortunately, my first class seats are taken,” a woman was heard saying, according to a recording received from ABC 7.

“What are they?” another person is heard to say.

“They are busy,” the woman replied.

Camille Henderson claims she was asked to move to the back of the plane to make room for two white women.

ABC 7

“Delta has no tolerance for discrimination in any form,” said an airline spokesman.

Yuki Iwamura / AFP via Getty Images

Henderson told the station that the flight attendants had then decided to give the women more space at her expense.

“Are you flying alone?” one hears one ask Henderson, who replies that it is her.

“There’s a seat in the back of lane 34. It’s a seat next to the aisle,” said the obvious employee.

Henderson, who said the crew did not ask the women to move, reluctantly agreed to go to the back row, according to the publication.

“In an attempt to reconcile [the women]they basically made me move, ”recalls Camille Henderson.

ABC 7

“I don’t want to turn it into a race, but instead of asking the two white women sitting next to me (to move) in an attempt to shelter them, they actually made me move,” she told ABC 7.

“I just don’t know why I had to move, because that was the place I paid for, that was my designated place,” she added. “It simply came to our notice then. It’s as if the whole flight is watching you and asking what’s going on. “

Henderson said she was not happy with what Delta’s customer service representative told her, whom she finally contacted by phone.

“How were you humiliated to be asked to go somewhere else?” One can hear one asking in a recording she provided to the store, suggesting that there was no inconvenience as she was moved elsewhere. in economics.

“You’re basically saying there’s nothing you can do?” she told the representative.

Camille Henderson told a Delta spokesman that the whole ordeal was “humiliating.”

ABC 7

“No, not in the circumstances I’m showing, ma’am,” the man was heard to reply.

A spokesman for the airline told ABC7: “We are looking into this situation to better understand what happened.

“Delta has no tolerance for discrimination in any form and these allegations run counter to our deep values of respecting and respecting the diversity of our customers,” he added.

Henderson vowed never to fly Delta again.

“As a black woman, I was displaced to accommodate two white women comfortably. That doesn’t make any sense to me, “she told the paper.

The black woman says Delta moved her to the back of the plane for white leaflets Read More »

Zoom in / A satellite image of Maxar shows the accumulation of Russian vehicles and helicopters at an airport in Belarus before the invasion of Ukraine.

Zoom in / A satellite image of Maxar shows the accumulation of Russian vehicles and helicopters at an airport in Belarus before the invasion of Ukraine.Maxar Technologies

Updated, 10 a.m. ET, March 1, 2022: On Tuesday, Mikhail Fedorov, Ukraine’s deputy prime minister and minister of digital transformation, confirmed that his country is seeking co-operation from commercial satellite operators. The aim is to obtain data, especially from synthetic aperture radar, on the movement of Russian vehicles so that Ukrainian forces can react.

“We really need the opportunity to observe the movement of Russian troops, especially at night, when our technology is actually blind!” “Satellite SAR data are important for understanding the movement of Russian troops and vehicles at night, given that clouds cover about 80 percent of Ukraine during the day,” Fedorov wrote in a letter. posted on Twitter.

@eos_da and @maxpolyakov called on global companies and remote monitoring organizations to provide real-time SAR data to support Ukraine’s armed forces with active intelligence. pic.twitter.com/DzfNze3K3r

– Mikhail Fedorov (@FedorovMykhailo) March 1, 2022

Ukrainian entrepreneur Max Polyakov made the initial request Monday night with an urgent request saying, “We need the data now.” His company EOS Data Analytics offers fast analysis and processing of data for use by the Ukrainian Defense Service. The company has created a web page here with more information.

Original post: Ukrainian entrepreneur Max Polyakov was emotional – and sometimes angry – during a 20-minute conversation with reporters Monday night as he spoke about the Russian military’s attack on his homeland.

“In an hour there will be another attack on Kyiv,” Polyakov said, pointing out his watch. “We need the data now.”

The data he mentioned were real-time observations made by trade satellites flying over Ukraine. Polyakov is urging the operators of these satellites, mostly Western companies that sell data to governments and private customers, to share their data freely with one of his companies, EOS Data Analytics.

Polyakov said the EOS would quickly process this data on passage through Ukraine and provide some basic analysis before sending the information to the Ukrainian Defense Service and the Ministry of Digital Transformation. The EOS has the ability to quickly distinguish 18 different types of Russian military vehicles, he said.

“We need to have that intelligence right now,” he said. “Every night we are bombed and at night we are blind. We need this information, please. “

Advertising

Polyakov noted that in recent days, commercial companies have been releasing high-resolution satellite images in public space to showcase their capabilities. While this is impressive, he acknowledged, such publications have been more useful for public relations purposes than for providing useful information to the Ukrainian military. The data is often two or three days old, Polyakov said. “We don’t need to know where the Russian tanks were two days ago,” he said.

He also pointed to the need for a special type of intelligence that has become increasingly popular in recent years: data from synthetic aperture radar or SAR, satellites. Unlike passive optical satellites, which collect data in the visible, near-infrared and short-wave infrared parts of the spectrum, these satellites emit their own energy. They then record the energy reflected back from the Earth’s surface.

The main advantage of SAR satellites is that they can collect data day and night and through the cloud cover. Polyakov said SAR satellite data is important for understanding the movement of Russian troops and vehicles at night, noting that clouds cover about 80 percent of Ukraine during the day.Zoom in / Screenshot of Polyakov speaking during a conversation on Zoom with a handful of reporters.

Noosphere / Magnification

Polyakov turned to Planet Labs, Maxar Technologies, Airbus, SI Imaging Services, SpaceView, BlackSky, Iceye, Capella and other companies that can provide the necessary data.

During a conversation with reporters, Polyakov admitted that he was making an “aggressive” request. The 44-year-old entrepreneur has an unequal relationship with US regulators and was recently – and unfairly for some observers – forced to sell his stake in US-based startup Firefly. However, the passion he clearly has for preserving his homeland is hard to deny.

It is not clear immediately how the trading companies will react. This was the first major war in which commercially available satellite images played a significant role in providing open source information on troop movements, military deployments in neighboring countries, refugee flows, and more.

Previously, such data were their own and were largely collected by a handful of nations. The role of such powerful, widely available technology has not yet been defined in the field of warfare, and it is unclear whether private companies are willing to freely transfer raw data to another trading company with the intention of helping one side in the conflict.

But we have yet to find out.