Mortgage rates fall just as house prices set a new record

The house is offered for sale by the owner on January 20, 2022 in Chicago, Illinois.

Scott Olson Getty Images

The house is offered for sale by the owner on January 20, 2022 in Chicago, Illinois.

Scott Olson Getty Images

Mortgage interest rates are falling as markets struggle with the effects of Russia’s attack on Ukraine, which means housing prices are likely to continue to rise.

The average interest rate on the popular 30-year fixed mortgage has risen close to full interest rates since the beginning of this year until last Friday, when it reached 4.18%, according to Mortgage News Daily. It is below 4% on Tuesday.

This will give home buyers more purchasing power with the start of the historically busy spring season. In addition, it will maintain record high house prices, which will continue to rise. Prices in January were 19.1% higher than the previous year, according to a report released Tuesday by CoreLogic. This level of growth is the highest since 45 years, when CoreLogic began to track prices.

“In December and January, inventories continued to be the lowest we’ve seen in a generation,” said Frank Nottaft, chief economist at CoreLogic. “Buyers continue to bid for limited supply.

Nothaft added that the rise in interest rates on mortgages since January has eroded the availability of buyers and that price growth should slow in the coming months, but it all depends on how long this decline in interest rates will continue. It may be short, given the way in which other factors weighing on the mortgage market are not related to the crisis in Ukraine.

Mortgage rates are weakly following the yield on the 10-year-old US Treasury, which fell to its lowest level since late January on Tuesday. Markets are experiencing instability due to Russia’s invasion of Ukraine.

For now, the Treasury move is causing interest rates to be withdrawn. But mortgage interest rates are managed more directly than the demand for mortgage-backed bonds. These bonds often mimic 10-year-olds, but not always and now is one of those not always periods.

Unlike Treasuries, the duration of MBS may vary depending on the demand for refinancing. A 30-year fixed-term loan rarely lasts 30 years. If people refinance or sell their homes faster, then the term of the bond does not last that long. Given higher interest rates now and more refinancing opportunities, MBS’s current harvest is not expected to last much more than five years, according to Matthew Graham, chief operating officer of Mortgage News Daily.

In the last three months, 5-year bonds rose 0.10% more than 10-year bonds. Because mortgage bonds behaved more like 5-year treasury bonds with shorter maturities, they had a harder time dealing with 10-year ones.

“The prospect of buying Fed bonds also hurts MBS more than Treasures, because the Fed accounts for a larger percentage of the total demand for buying new MBS,” Graham said. “So if the Fed leaves (which is underway), MBS prices need to fall even more to attract buyers. Lower MBS prices = higher interest rates, other things being equal.”

However, given geopolitical tensions, there is now a greater demand for short-term debt, so mortgage interest rates are at a better pace with the wider bond market. The question is how long it will be, and the answer depends on what is happening in Ukraine and abroad.

Mortgage rates fall just as house prices set a new record Read More »

Here are the most important news, trends and analyzes from which investors should start their trading day:

1. Stock futures start lower in March as Russia heads to Kyiv

NYSE Traders on February 28, 2022

Source: NYSE

US stock futures fell on Tuesday, the first day of March, when Russia clashed with the Ukrainian capital Kyiv. Bond yields fell as oil and bitcoins jumped. Investors are also concentrating on retail profits, with Target shares rising 12% after forecasting continued sales growth.

The Dow Jones Industrial Average and S&P 500 broke the winning streak of two sessions with modest losses on Monday; although they were quite the lowest points of the day. The rally at the end of the session actually pushed the Nasdaq positively. For the whole of February, the three benchmarks of shares fell by more than 3% each.

2. Target stocks are rising as the retailer forecasts growth after the pandemic

David Paul Morris Bloomberg | Getty Images

Target ended in 2021, saying it tackled the challenges of the supply chain on Tuesday and relied on e-commerce and customer profits during the Covid pandemic. Earnings for the fourth quarter exceeded forecasts, while revenue was missed. But stocks did rise better than expected for the full year on top and bottom lines and rosy operating margins.

Target said Monday that it will spend $ 300 million more next year on salaries and health benefits. Starting salaries will range from $ 15 to $ 25 per employee per hour, based on their roles and local markets. About 20% more employees will be eligible for medical benefits.

3. US oil exceeds $ 101 a barrel as bond yields fall, bitcoin jumps

Satellite images from Maxar Technologies, taken on February 28, appear to show a convoy of Russian vehicles advancing toward the Ukrainian capital, Kyiv. The company says these images show the northern end of the convoy, with logistics and supply vehicles. Satellite image (c) 2022 Maxar Technologies.

Maxar Technologies | Getty Images

U.S. oil prices jumped more than 4 percent on Tuesday, with West Texas Intermediate oil surpassing $ 101 a barrel, its highest level since July 2014, after Russia hit Ukraine’s second-largest city, Kharkiv, and A 40-kilometer convoy approached Kyiv. US sanctions for Moscow’s unprovoked invasion of Ukraine are not aimed at oil from Russia, which exports about 4 to 5 million barrels of crude oil a day.

Investors also sought bond security, pushing back 10-year bond yields to about 1.77% on Tuesday. Bitcoin jumped 6%, albeit away from overnight highs, to about $ 44,400. Proponents of cryptocurrency see bitcoin as a refuge and a means of storing value such as gold. Real gold prices also rose by more than 1% to approximately $ 1920 an ounce.

4. The President of Ukraine says that “no one will break us”

This general view shows the damaged local town hall of Kharkiv on March 1, 2022, destroyed as a result of shelling by Russian troops.

Sergey Bobok AFP | Getty Images

On the sixth day of Russia’s invasion of Ukraine, fighting went beyond military targets, with Associated Press reporters documenting evidence of shelling of homes, schools and hospitals. The Kremlin denies this. The first round of talks between Ukraine and Russia failed to lead to a ceasefire. The two sides agreed on a new meeting in the coming days.

Ukrainian President Volodymyr Zelensky addressed the European Parliament on Tuesday, saying “no one will break us.” Earlier in a Facebook video, Zelensky called the shelling of Kharkiv “undisguised terror” that “no one will forget.” He also said keeping Kyiv was a “key priority”.

5. Biden is preparing for the state of the Union during turbulent times

US President Joe Biden pauses as he speaks at an event marking Black History Month at the White House in Washington, DC, February 28, 2022.

Kevin Lamarck Reuters

President Joe Biden will deliver a speech on the state of the Union on Tuesday night, facing turmoil both abroad and at home. From Russian aggression, bringing the United States out of the pandemic through a strained social and climate agenda, to rising inflation, Biden is addressing a nation that studies say is disappointed with its performance in the White House.

Biden will speak to a predominantly full and optional crowd in the House of Commons, one of the signs of mitigating the Covid threat. But his speech will also be from the newly fenced Capitol due to renewed security concerns after last year’s uprising.

– The Associated Press contributed to this report. Get involved now for the CNBC Investment Club to follow Jim Every movement of Kramer’s shares. Follow broader market actions as a professional CNBC Pro.

5 things you need to know before the stock market opens on Tuesday, March 1 Read More »

People wear protective masks in front of the headquarters of Uber Technologies Inc. in San Francisco, California, USA, on Wednesday, June 9, 2021.

David Paul Morris Bloomberg | Getty Images

A new feature of Uber’s “Explore” announced on Tuesday will allow users to book reservations for dinner, concert tickets and other events directly through the Uber app.

This change demonstrates the transportation app’s strategy to expand beyond travel in an attempt to build new revenue streams. The company is investing heavily in its Uber Eats food, beverage and convenience services during the pandemic, and this segment continues to outperform travel. Shipping revenue of $ 2.42 billion exceeds $ 2.28 billion generated by the core vehicle business, for example.

This new feature, Uber Explore, will appear as a new tab in the Uber app. Consumers can purchase tickets with their Uber Wallet or credit card.

The Research section will show categories including food and drink, arts and culture, nightlife, music and shows, and will provide personalized recommendations based on where consumers have traveled in the past. With the ride there now feature, users can book a trip to the destination they just bought.

Uber Explore is available from Tuesday, starting in Atlanta; Chicago; Dallas; Houston; Los Angeles; Memphis, Tennessee; Minneapolis-St. Paul, Minnesota; New Orleans; Orlando, Florida; San Antonio; San Francisco and Seattle. It is also live in New Jersey, upstate New York, and Mexico City, Mexico.

Uber’s new feature allows you to book dinner reservations, concert tickets Read More »

Chris Foyel, CEO of Stellantis ‘Chrysler brand, presented the all-electric Chrysler Airflow Concept during Stellantis’ CES 2022 press conference at the Las Vegas Convention Center on January 5, 2022 in Las Vegas, Nevada.

Alex Wong | Getty Images

Stellantis, formerly known as Fiat Chrysler, intends to double its net revenue to 300 billion euros ($ 335 billion) by 2030, CEO Carlos Tavares announced on Tuesday.

The carmaker plans to do so while maintaining a double-digit operating profit margin as it largely shifts to all-electric vehicles, Tavares said during an investor presentation outlining Stellantis’ 2030 business plans.

The plans reflect those of other major carmakers such as Volkswagen and General Motors to remain profitable as they switch to all-electric vehicles. The transitions are moving from increasingly stringent global emissions regulations and the rise of Tesla to the world’s most valuable carmaker by market capitalization.

Stellantis – the world’s fourth-largest automaker – plans to expand its software business and services and sell 5 million all-electric vehicles by 2030, including all passenger car sales in Europe and 50% of U.S. passenger cars and light commercial vehicles.

“We are moving and moving fast to be a mobility technology company,” Tavares said during the event.

The carmaker plans to generate more than 20 billion euros ($ 22.3 billion) in industrial free cash flow in 2030. It is also aiming for a dividend payout ratio of 25% to 30% and intends to buy back up to 5 % of open ordinary shares by 2025

Stellantis plans to be carbon neutral by 2038, with a 50% reduction by 2030, the company said.

The announcements did not help much for the company’s shares. Shares of Stellantis on the New York Stock Exchange fell about 4% on Tuesday morning to $ 17.50 per share. The company’s shares have risen by about 10% since the merger.

Stellantis was created by merging Fiat Chrysler and France-based Groupe PSA in January 2021. It has 14 separate car brands, including Alfa Romeo, Chrysler, Dodge, Fiat, Jeep and Peugeot.

Stellantis will launch Jeep’s first all-electric SUV in early 2023. The company unveiled the car on March 1, 2022, during Investor’s Day.

Stelantis

The automaker plans to launch at least 25 new all-electric vehicles in the United States by 2030, Tavares said. Among the first will be a small SUV Jeep next year and a muscle car Dodge and pickup Ram by 2024. Globally, the company expects to offer more than 75 EVs by 2030.

Stellantis is investing € 30 billion ($ 34 billion) in electric vehicles and technology support by 2025.

The company’s electrification strategy in the short term differs from other car manufacturers. It still plans to launch plug-in hybrid electric vehicles or PHEVs in the coming years. PHEVs combine electrical systems and batteries with internal combustion engines.

Jeep maker Stellantis aims to double its revenue by 2030 Read More »

Test drive: Jeep Grand Cherokee L

The Jeep Grand Cherokee L 2021 is the first three-row version of the model, and Fox News Autos editor Gary Gastelou says it lives up to its name.

NEWYou can now listen to Fox News articles!

Jeep has introduced the first of two all-electric models to come soon in its range.

Jeep’s first all-electric car will go on sale in the first half of 2023. (jeep)

Carlos Tavares, CEO of Jeep, a parent of Stellantis, said on Tuesday during a presentation on the carmaker’s long-term strategic perspective that the SUV will go on sale early next year, calling it a “family vehicle for lifestyle”. “, And added that it is clean – Road Jeep will join it for the model year 2024.

The electric SUV is described as a vehicle for the “lifestyle family”, but will be followed by off-road EV. (jeep)

Tavares shared an image of the vehicle, but not its name or technical details. However, the yellow useful vehicle seems to be similar in size to the current Jeep Compass.

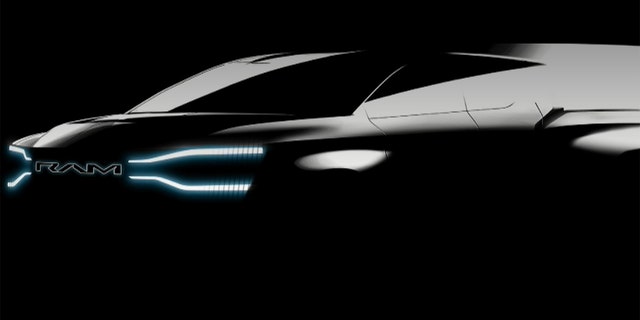

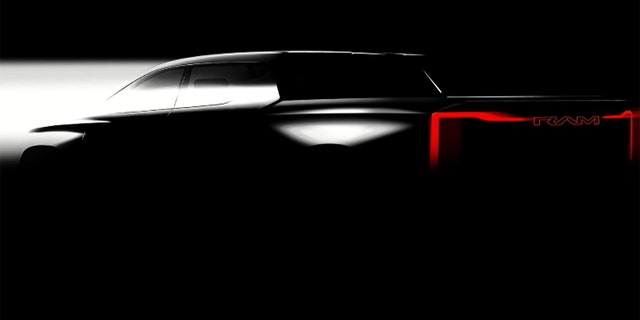

The first electric Ram 1500 is scheduled to go on sale in the 2024 model year. (frame)

He also confirmed that the Ram 1500 electric pickup will be available in 2024 and said it would be the “best” in the segment, with class-leading range, towing and charging speed. Ford and General Motors will have full-size electric pickups on sale by the time Ram enters showrooms.

Ram claims that it will have best-in-class range, towing and loading speed. (frame)

After the electric lightweight Ram, the company will add a heavy-duty model equipped with a hydrogen fuel cell drive that will provide a long-range combination with fast charging capability.

CLICK HERE TO DOWNLOAD THE FOX NEWS APPLICATION

Earlier in February, Ram CEO Mike Koval said the electric Ram 1500 would be available in an extended-range model that uses an internal combustion engine to generate electricity for longer journeys after the battery is depleted.

Tavares also said a concept version of the previously announced Dodge electric muscle car would be unveiled later this year.

Stellantis unveils first electric SUV, says Ram EV pickup will be “best” Read More »

In case you haven’t noticed, Nike products are becoming harder to find in stores.

The popular sportswear and sneaker company is severing ties with some of the country’s largest shoe retailers.

Now Foot Locker, another popular shoe retailer, is gearing up to take Nike products off its shelves.

Foot Locker announced last week that no vendor is expected to account for more than 60% of its business in 2022. Nike represents 70% of Foot Locker’s business in 2021 and 75% in 2020.

“This change reflects Nike’s accelerated strategic shift directly to consumers and Foot Locker’s ongoing efforts to diversify the brand and category,” said Andrew Page, CFO of Foot Locker, in a profit talk.

Foot Locker will build on existing relationships with brands such as New Balance, Puma and Crocs to fill the gap.

Nike wants to offer customers a “premium experience” by using a more business-oriented approach. The company plans to designate certain stores or sections of stores only for Nike products.

Nike has not yet announced what action it will take at retailers such as Dick’s Sporting Goods and Finish Line.

Nike has previously pulled products from Dillard’s, Macy’s, Urban Outfitters, Olympia Sports, Shoe Show and Zappos – and most recently from DSW stores.

There are currently 34 Foot Locker stores in New Jersey and over 2,900 nationwide.

RELATED STORIES ON RETAIL AND SHOPPING:

Chick-fil-A follows the recent opening in New Jersey with another

Wawa opens another store in New Jersey, 3 more are on the way

A popular pizzeria in New Jersey says it’s closing

Our journalism needs your support. Please subscribe today for NJ.com

You can contact Christopher Birch at [email protected]. Follow him on Twitter: @ ChrisBurch856. I find NJ.com on Facebook. Do you have any advice? Tell us. nj.com/tips

A foot cabinet that prepares to pull Nike products off the shelves Read More »

When Berkshire Hathaway CEO Warren Buffett talks to college students, he offers some valuable career advice: Look for personal fulfillment over net income.

That means pursuing a job that you actually enjoy, in a workplace with talented people that you actively admire, Buffett wrote in his annual letter to shareholders on Saturday. Or, to put it another way, he advised: jobseekers should look for a job in the field “they would choose if they didn’t need money”.

“Economic realities, I admit, can hinder this kind of demand,” Buffett continued. “However, I urge students never to give up the search, because when they find this kind of job, they will no longer ‘work.’

The 91-year-old billionaire – currently the fifth richest man in the world, with a net worth of 114.7 billion dollars according to Forbes – speaks from personal experience. In his letter, Buffett wrote that he and his business partner, Charlie Munger, Berkshire’s vice president, both began as “part-time” at his grandfather’s grocery store in the early 1940s, where they were they were “assigned boring tasks and paid little.”

“Job satisfaction continued to elude them,” Buffett wrote, even as they branched out into selling securities and law, respectively. That changed when the duo “found what [they loved] to do ”in Berkshire, which Buffett bought in 1965, forcing the company’s previous management to leave.

At the time, Berkshire was a troubled textile company. Today, it is an investment and holding company that owns or holds long-term stakes in businesses such as Geico, Fruit of the Loom, American Express and Coca-Cola. It has a market capitalization of $ 708.61 billion as of Tuesday morning.

Buffett’s wealth was largely due to the last decades of Berkshire’s financial success, and in his letter, Buffett attributed this success in part to finding people he and Munger loved to work with. “We hire decent and talented people – no fools,” Buffett wrote. “The turnover is on average maybe one person a year.”

Berkshire may have been ahead of the curve in this regard: low turnover is becoming increasingly known as a recipe for particularly productive and profitable jobs. As CNBC Make It recently noted, “enthusiastic remnants” – who make up a third of the workforce – are more engaged, more productive and help businesses become more profitable, according to a December 2020 study published in the Journal of Managerial Issues.

Buffett seems to agree with these findings.

“With very few exceptions, we have now been ‘working’ for many decades with people we like and trust,” he wrote. “It’s the joy of life.”

Join now: Get smarter about your money and career with our weekly newsletter

Do not miss:

Warren Buffett and Charlie Munger: “We made a lot of money”, but here’s “what we really wanted”

Renee Jones, one of the four black executives at Fortune 500, for her “secret” to success: “You have to tell your story”

Seek personal happiness in the face of pure profit Read More »

The total number of barrels released worldwide could range from 50 million to 60 million barrels, senior officials and others familiar with the matter said, although sources warned that the decision was not yet finalized and discussions were still ongoing. Tuesday morning.

Other allies are expected to dive into their reserves in a coordinated effort to reduce energy costs amid Russia’s ongoing invasion. These include Germany, the United Kingdom, Italy, the Netherlands and other major European countries, as well as Japan and South Korea.

The invasion of Ukraine has raised fears of disruptions in supplies from Russia, the world’s No. 2 oil producer. Brent oil prices closed above $ 100 a barrel on Monday for the first time since 2014. U.S. crude and Brent jumped another 5 percent on Tuesday, even as the International Energy Agency meets to discuss a response to the Russia-Ukraine crisis.

High oil prices have raised petrol pump prices to seven-year highs. The average for regular gasoline for the country rose to $ 3.62 on Tuesday, about 9 cents a week and 24 cents a month, according to the AAA. At some point, energy prices can become so expensive that they undermine consumer demand and slow down the economy more broadly.

U.S. officials have spent the past few weeks talking and meeting with partners from key energy-supplying countries in an effort to secure commitments to fill any market disruptions. The effort included a personal visit to Saudi Arabia by two senior administration officials to discuss the need to address the impact on oil markets. The United States informed Saudi Arabia before the announcement of the oil reserve.

The White House has not made any specific commitments, and White House spokeswoman Jen Psaki declined to say whether there was a specific request to increase supplies when asked at a briefing this week.

Biden signaled his intention to release oil last week.

“We are working actively with countries around the world to assess the collective release of strategic oil reserves of major energy-intensive countries. And the United States will release additional barrels of oil if conditions require,” he said.

The Paris-based International Energy Agency is holding a last-minute meeting Tuesday on oil supplies to “stabilize markets”, he said earlier this week. The meeting will be chaired by US Secretary of Energy Jennifer Granholm.

The use of the reserve – a stockpile of 600 million barrels of crude oil stored in underground salt caves in Louisiana and Texas – usually has only a limited effect on gas prices because of how much oil can be released at a time but would act as a political sign. that Biden is facing the problem.

Chevron CEO Mike Wirth voiced support Tuesday for governments to release emergency oil stocks to offset fears of supplies sparked by Russia’s invasion of Ukraine.

“I think a coordinated response from multiple countries can help in the short term,” Wirth said in response to a question from CNN during a briefing with reporters. “Of course, we saw markets on the edge with concerns about supply and security of supply.”

Wirth expressed confidence that there would be no serious supply disruptions.

“I have seen nothing to indicate that either Russia’s intentions or the intentions of the governments involved in the sanctions would be to limit oil supplies,” Wirth said. “In fact, the opposite is true. It seems to me that people have been very careful to signal that their intention is to try to maintain the world’s energy supply that needs it.”

This story has been updated with additional reports.

CNN’s Matt Egan contributed to this report.